Introduction to Databricks Stock and its history

Databricks has emerged as a powerhouse in the world of data analytics and artificial intelligence. Founded in 2013 by the original creators of Apache Spark, this innovative platform has transformed how businesses harness big data. As its reputation grows, so does curiosity about its stock performance. With an increasing number of companies recognizing the importance of data-driven decision-making, investors are keen to know: Is Databricks Stock worth your hard-earned money?

In this blog post, we’ll delve into the history of Databricks Stock and explore its current standing in the market. We will analyze financial performance and compare it with other tech giants while also addressing potential risks that could impact future growth. Whether you’re a seasoned investor or just starting out, understanding where Databricks fits into today’s investment landscape is crucial for making informed decisions. Let’s dig deeper!

Overview of the current state of the Databricks Stock market

The current state of Databricks stock reflects a dynamic period in the tech market. As more companies pivot to data-driven strategies, interest in this leading analytics platform has surged.

Recent trading trends indicate fluctuations influenced by broader economic factors and investor sentiment. The demand for cloud-based solutions continues to grow, positioning Databricks as a key player amidst these changes.

Market analysts are closely monitoring its performance. With strategic partnerships and product innovations on the horizon, there’s an air of optimism surrounding its future trajectory.

However, volatility remains a constant companion in technology stocks. Investors should keep an eye on external variables that could impact pricing dynamics significantly.

As the landscape evolves rapidly, staying informed about movements within the Databricks stock market is crucial for prospective investors seeking opportunities or assessing risk profiles.

Analysis of Databricks Stock financial performance

Databricks has carved a niche in the data analytics landscape. Its financial performance reflects strong growth potential.

In recent earnings reports, Databricks showed impressive revenue increases year-over-year. This indicates robust demand for its cloud-based solutions. The company leverages machine learning and big data to enhance business operations.

Profit margins have also seen improvement, suggesting effective cost management strategies are in place. Investors appreciate a company that can balance growth with profitability.

However, examining cash flow is essential too. Positive cash flow can signal long-term sustainability, which is critical for tech stock investments like this.

Investor sentiment around Databricks remains optimistic but cautious due to market volatility. Keeping an eye on these metrics will provide deeper insights into its financial health moving forward.

Comparison with other tech companies in the market

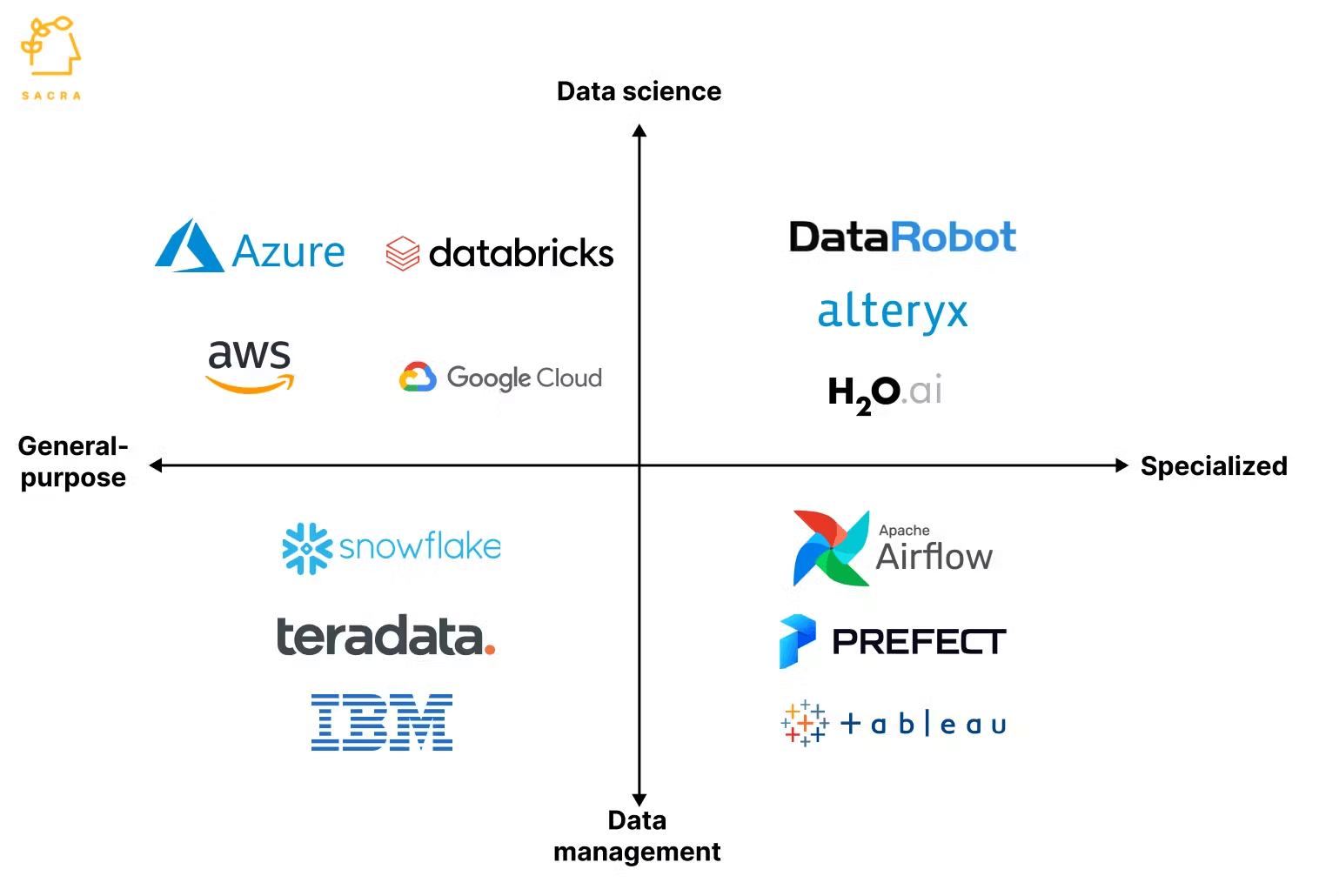

When comparing Databricks stock to other tech companies, several factors come into play. Its focus on big data analytics and AI positions it uniquely in the market. Unlike traditional firms like IBM or Oracle, Databricks leverages a cloud-native approach that appeals to modern businesses.

Competitors such as Snowflake have also gained ground by offering similar data solutions. However, Databricks distinguishes itself with its collaborative workspace for data scientists and engineers, enhancing productivity.

Tech giants like Microsoft and Google provide extensive cloud services but often lack the specialized tools tailored for machine learning that Databricks offers. This specialization can be an attractive point for investors seeking growth in niche markets.

As the demand for scalable data solutions continues to rise, understanding these dynamics helps gauge where Databricks stands among its peers. The competitive landscape is constantly evolving, making it essential to keep an eye on emerging trends within this sector.

Potential risks and challenges for Databricks Stock

Databricks operates in a highly competitive landscape. With big players like Amazon, Google, and Microsoft offering similar services, the pressure is immense. These companies have vast resources that allow them to innovate rapidly.

Market volatility also poses challenges. Economic downturns can lead businesses to cut back on data projects. This affects Databricks directly as client budgets tighten.

Another concern is reliance on cloud infrastructure providers. If partnerships falter or pricing changes dramatically, it could impact profitability.

Regulatory pressures are increasing too. As data privacy laws evolve globally, compliance costs may rise for Databricks.

Talent acquisition remains crucial. The demand for skilled professionals in AI and machine learning creates fierce competition within the tech industry. Retaining top talent will be key to maintaining innovation and growth momentum.

Expert opinions on investing in Databricks stock

Expert opinions on Databricks stock vary widely, reflecting the company’s unique position in the tech landscape. Some analysts highlight its robust growth trajectory and innovative data management solutions as strong indicators for long-term success.

Investors are particularly intrigued by Databricks’ focus on artificial intelligence and machine learning. These technologies are increasingly vital across industries, positioning the company well to capture future market share.

However, some experts caution about potential volatility. The competitive nature of the tech sector means that even promising companies can face significant challenges from emerging players or shifting consumer preferences.

Many financial advisors recommend keeping a close eye on quarterly earnings reports and customer acquisition metrics. These factors will be crucial in determining if Databricks can maintain its growth momentum amidst an evolving marketplace.

recommendations for potential investors

For potential investors eyeing Databricks stock, a strategic approach is essential. Start by conducting thorough research on the company’s innovative technology and its applications in data analytics and artificial intelligence.

Consider diversifying your portfolio. While Databricks shows promise, balancing investments across different sectors can mitigate risks associated with tech stocks.

Stay updated on market trends and performance metrics. Regularly review quarterly earnings reports to gauge growth trajectory and profitability.

Engaging with financial advisors who understand the tech landscape can provide valuable insights tailored to your investment strategy.

Be prepared for volatility in the tech sector. Patience is key; long-term gains often outweigh short-term fluctuations in stock prices.

Conclusion

Investment decisions require careful consideration of various factors. Databricks stock presents a compelling opportunity, but it also comes with its own set of risks and challenges. With the company’s strong foothold in the data analytics space and increasing demand for data-driven solutions, there is significant potential for growth.

However, investors should weigh these opportunities against market volatility and competition from other tech giants. Keeping an eye on financial performance metrics will be essential for assessing future prospects. Moreover, expert opinions suggest that while Databricks shows promise, thorough research is crucial before diving in.

Prospective investors must evaluate their risk tolerance and investment strategy when considering Databricks stock as part of their portfolio. The landscape may change rapidly; staying informed will be key to making sound investment choices moving forward.